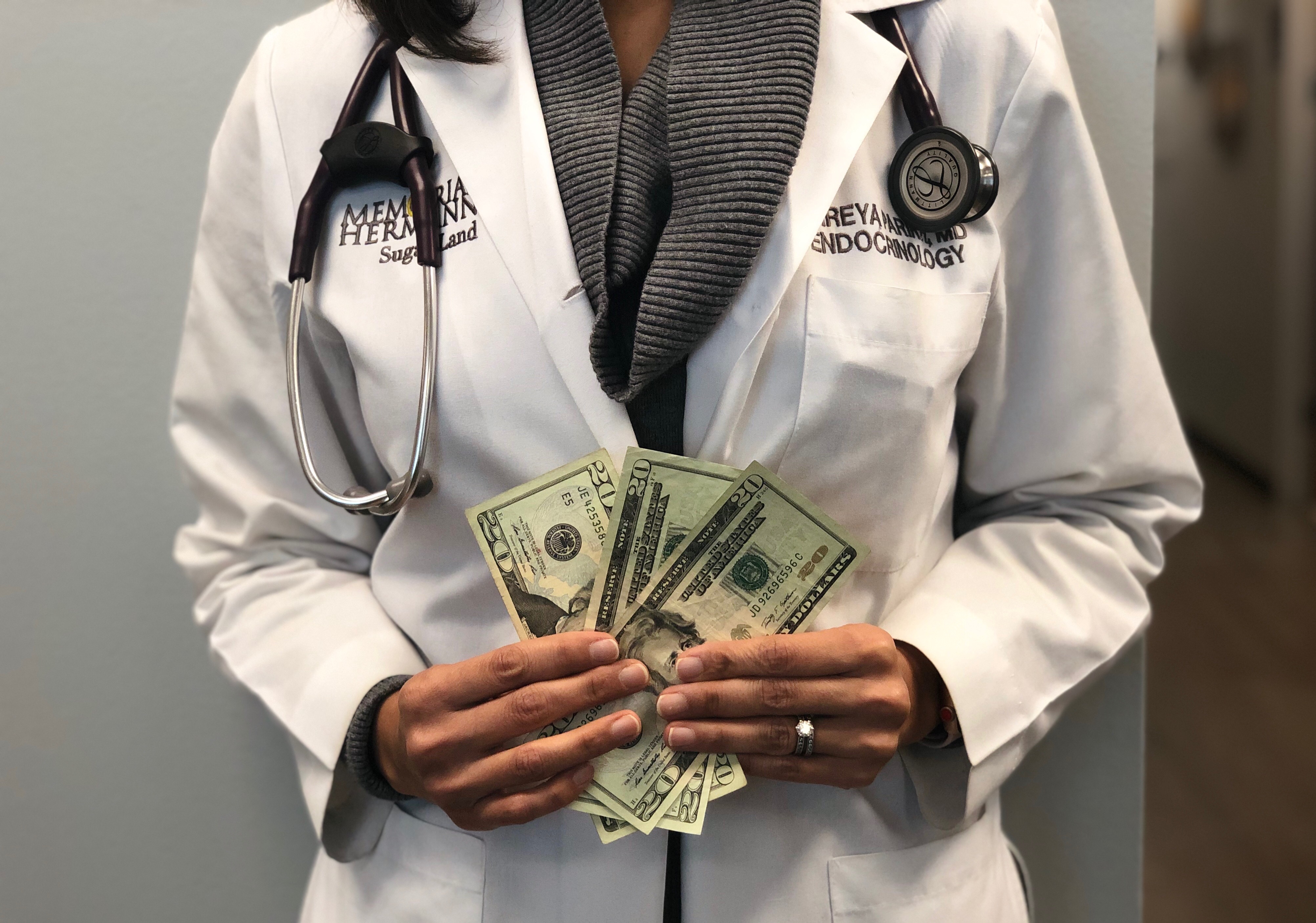

Healthcare is expensive. Not only are we paying big bucks for our monthly health insurance premiums, but when we have tests done – think ultrasound, MRI, lab work, X-ray – we still get a fat bill. And the price for some long-term medications can rival that of a 4-star vacation.

For some, these costs mean putting off going to the doctor all together. But don’t. There are some easy ways to save on healthcare that maybe no one ever told you, especially your own doctor.

Here are some Centsible tips to help reduce these costs and keep more money in your pocket:

1. Use discount cards for medications.

It would be nice if all our medications had a generic alternative, but that’s not the case for many chronic illnesses. Ask your doctor’s office for discount cards for branded medications. If they don’t have them, you can print most of them online. A lot of branded medications have a co-pay card, so before you spend hundreds of dollars on a drug, check their website. For example, some diabetes medications have a copay card that bring the medicine to $0.

(The one exception to this is if you have a governmental plan such as Medicare, Medicaid, or Tricare. If you have one of those plans you are excluded from using discount cards.)

2. Check your insurance before seeking medical care.

Make sure you are going to an in-network provider. If you have an HMO or any other plan requiring a referral, get the referral BEFORE going to the doctor. Saves both time and money.

Understand your copays, deductibles, co-insurances, etc. Do you pay a copay for office visits? Or does it come out of your deductible? Rather than being blindsided at the doctor’s office; check with your insurance before you go.

You can set up an online account on your insurance’s website and check your benefits that way. Or, you can always call your insurance direct (sometimes old school is still cool).

3. Shop Around.

Need an ultrasound, X-ray or MRI? Compare prices!!

You do this for all your other purchases – clothes, household supplies, gasoline, cars, etc. Why wouldn’t you compare prices for your medical procedures? Call ahead to several places to compare the cost – this means clinics, hospitals, labs and doctor offices. You might be surprised at the different prices. And if you’re not using insurance, ask if they’ll give you a cash discount. Cash discount…it’s a thing.

4. Check your bills before paying.

Before paying any health related bills, always check your EOBs (Explanation of Benefits) first. They either come by mail or you can view online. Make sure the amount you are being billed is the same amount the insurance is saying you owe. If something seems off, call the doctor’s office and/or insurance for clarification. Healthcare billing is confusing, even for the doctor’s office, so there can be mistakes. Sometimes the claim just needs to be re-submitted with a different code for better coverage. Therefore, it is always a good idea to do research before paying it.

I hope you find this information helpful and can use these tips to help save money on your healthcare expenses.

Disclaimer: The information on this blog is for educational and informational purposes only. This information may not apply to every insurance plan. You must always check with your specific insurance for any advice.

Robin Seidl

9 Dec 2020This was a perfect article for me right now. Dealing with some medical issues with my husband & been checking with the insurance & doctors with different options. Thank You!

Rebecca Southern Mills

10 Dec 2020Great tips! I try to always compare the EOB with a bill before paying it. I’ve received bills that were sent before insurance finished processing, and I avoided the headache of overpaying and then waiting on a refund by making sure the amounts matched. Thanks for such great information!